As we ended our Global Private Offering on June 30th, most of the investors' questions now focus on our High-Yield Notes which pay a 20% annual interest rate.

Possibly the most common question is on why we set up such a high interest rate, when typical corporate bonds only pay 4-5%.

There were two reasons for that:

- unlike most corporations, we can easily afford to pay 20% due to the high value multiplication capacity of Unicorn Hunters and

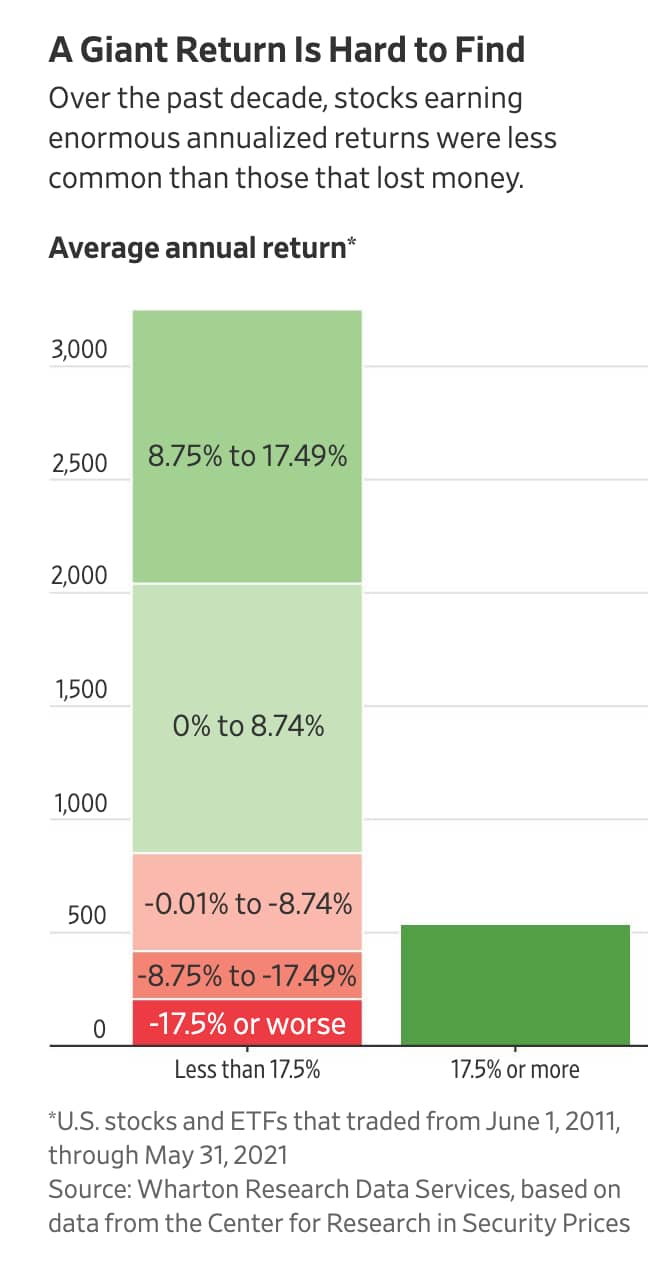

- 20% coincides with the earning expectations of U.S. investors, as discussed in this WSJ report:

Prev news

Prev news