Explore our Video Gallery

Unicorn Hunters, our revolutionary enrichtainment show, opens access to pre-IPO investment opportunities to the global audience.

- MARKET OPPORTUNITY

Pre-IPO financing can result in a ROI up to 30,000,000% but, until recently, it was largely closed to individual investors. VC funds used to be the primary beneficiaries of successful IPOs. TransparentBusiness is democratizing access to pre-IPO investment opportunities, featuring the most scalable emerging growth companies on its Unicorn Hunters show, watched by millions of people around the world, including high net-worth individuals and active investors. Global Private Offerings facilitated by our show are expected to raise $20M-$300M, propelling many of the featured companies towards a “unicorn” exit with TransparentBusiness as a significant shareholder.

- BUSINESS MODEL

Launched as a SaaS business in the Remote Workforce Management category, TransparentBusiness is now transitioning to becoming a unicorn-minting factory. Our UNICORNS subsidiary takes equity stakes in the companies featured on our show. Currently, the fee is set at 5% of their equity, but we expect this number to increase to 10% by 2022. By cost-effectively developing a diversified portfolio of equity positions in numerous emerging growth companies we expect to outperform traditional venture capital funds. Identifying “the next Zoom” would result in up to $16B earnings on the stock we received as a 10% fee.

- EFFICIENCIES

Our UNICORNS subsidiary acquires equity stakes in emerging growth companies for a fraction of what VC funds would have to pay for the same equity stakes. Further, TransparentBusiness expects to have access to the best pre-IPO opportunities by becoming the most-watched business show in the world.

- TRACTION

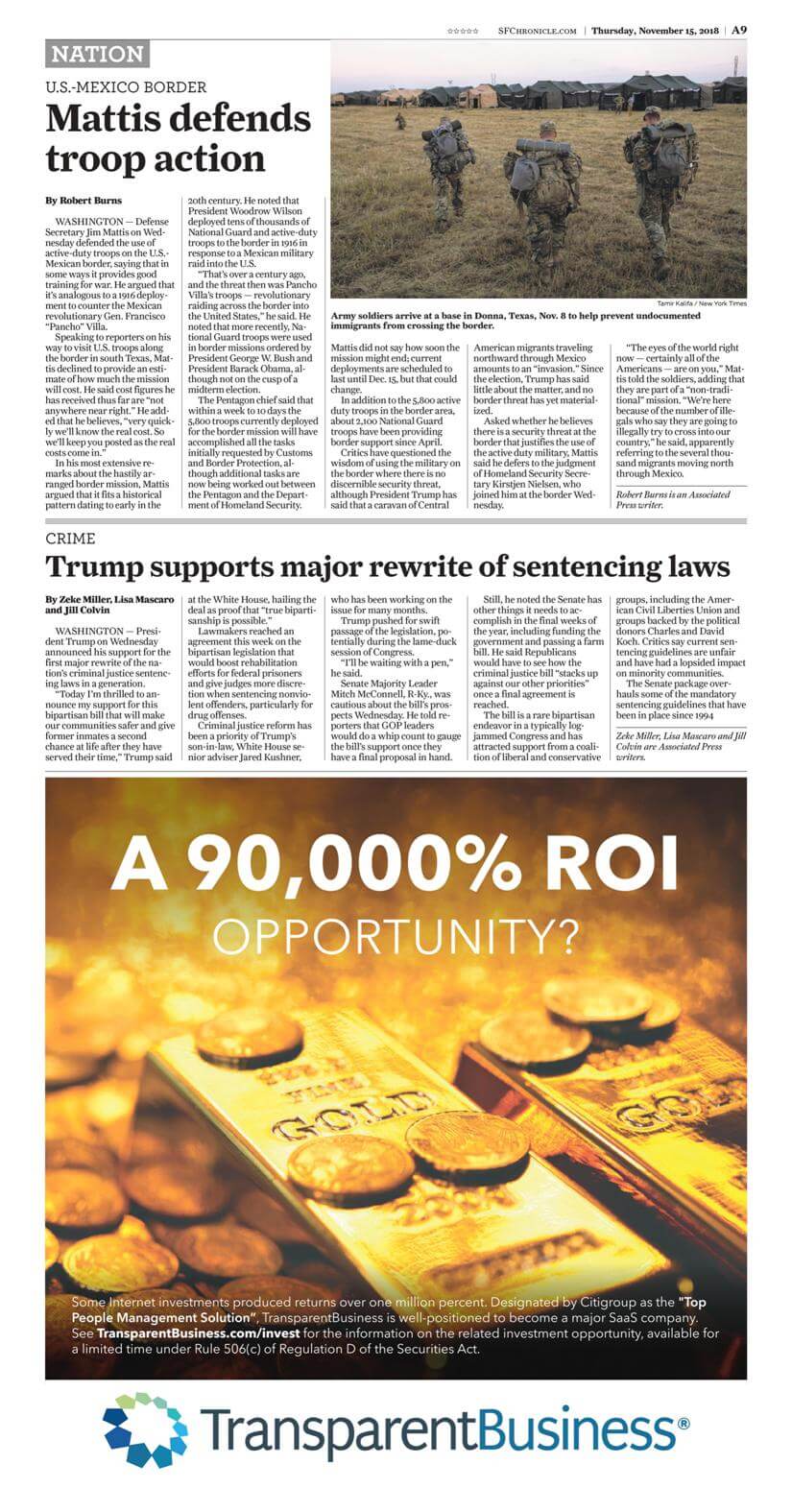

TransparentBusiness’ Unicorn Hunters show has received extensive international media acclaim and has been watched by millions of prospective investors. Some major TV networks have expressed interest in broadcasting the Unicorn Hunters show.

- COMPETITION

TransparentBusiness identified a new market niche not yet dominated by any company and seeks to convert its first-mover advantage into creating the primary brand in the pre-IPO crowd financing category. Shows like Shark Tank or Dragon’s Den cannot be considered competitors as they do not allow for audience participation.

- VALUATION

We completed our $4/share round of our Global Private Offering (approximate valuation: $3.2B).

- EXIT

TransparentBusiness is in the process of becoming a public reporting company under the SEC rules, with the objective of exceeding the $58B valuation achieved by Robinhood.

- OUR INVESTORS

We’ve raised approximately $50M in our previous rounds and we plan on going public in the near future. Our investors include current and former executives of Morgan Stanley, Merrill Lynch, J.P. Morgan, Stifel, Bank of America, Barclays Global Investors, UBS, Wells Fargo, Goldman Sachs, Citigroup, Trust Company of the West, Deutsche Bank, CA Technologies, IBM, LinkedIn, Microsoft, and Accenture.

Episodes of our Unicorn Hunters show

| Round | Size | Price / share | Shares million | Valuation | Cumulative | Status |

| 1 | $2M | 1-8 c | 80 | $25M | $2M | Completed |

| 2 | $4M | $0.10 | 40 | $70M | $6M | Completed |

| 3a | $4.5M | $0.20 | 23 | $145M | $10.5M | Completed |

| 3b | $2M | $0.30 | 7 | $228M | $12.5M | Completed |

| 3c | $4.5M | $0.60 | 8 | $470M | $17M | Completed |

| 3d | $7.5M | $1.00 | 8 | $785M | $24.5M | Completed |

| 4a | $20M | $2.00 | 10 | $1.6B | $44.5M | Completed |

| 4b | $6M | $3.00 | 2 | $2.4B | $50.5M | Completed |

| 5 | $15M | $4.00 | 2.5 | $3.2B | $65.5M | Completed |

Board of Directors

"Mr. Konanykhin was a whiz-kid physics student who became a pioneering Russian capitalist in early 1990s, building a banking and investment empire valued at an estimated $300 million all by his mid-20s.” In 1992, Alex defected to the United States and was granted political asylum for opposing corruption.

An award-winning serial entrepreneur, international speaker and author, Silvina Moschini, has established herself as one of the foremost experts on the digital economy. She is an LinkedIn Influencer, a regular contributor to CNN and a subject of countless articles in the news media worldwide.

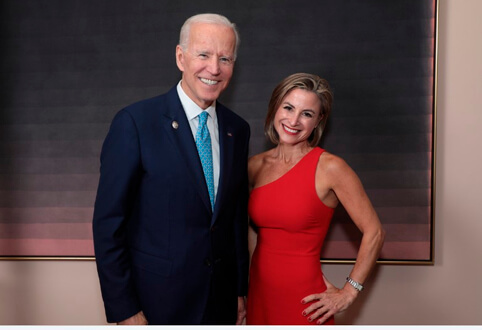

Public Recognition

Silvina Moschini, a co-founder and the President of TransparentBusiness, with Mark Zuckerberg, the founder of Facebook. TransparentBusiness is a technology partner of Facebook.

TransparentBusiness team is working on making transparent verification of billable hours the new standard of public procurement. Such transparency will save billions of dollars to taxpayers, by protecting public funds from overbilling by contractors, see our AvoidOverbilling.com.

Senator Jim Nielson and Assemblymember Ken Cooley presented Alex Konanykhin CEO of TransparentBusiness, the California State Senate Certificate of Recognition for Economic Development