Earn 20% per year

on our High-Yield Notes.

on our High-Yield Notes.

This year our company has reached a $3.2 billion valuation and, transitioning from the “unicorn" stage to the "unicorn factory” stage, launched the Unicorns project with the purpose of developing a diversified portfolio of equity positions in numerous emerging growth companies. The value multiplication capacity of this FinTech project enables us to pay the interest rate of 20%, four times higher the market average.

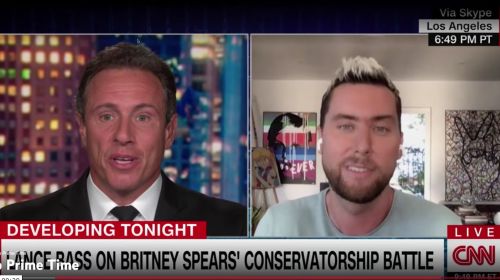

The most visible element of the project is our Unicorn Hunters show, which we produce in collaboration with Steve Wozniak (Co-founder of Apple), Rosa Rios (former Treasurer of the United States), Moe Vela (former Director of Administration of Joe Biden and his former Senior Advisor) and John Bercow, (former Speaker of House of Commons of the United Kingdom). Through the show we

TransparentBusiness investors include current and former executives of Morgan Stanley, Merrill Lynch, J.P. Morgan, Stifel, Bank of America, Barclays Global Investors, UBS, Wells Fargo, Goldman Sachs, Citigroup, Trust Company of the West, Deutsche Bank, CA Technologies and Accenture. As we are progressing fast towards making Unicorn Hunters the most-watched and the most-impactful business show in the world, with the goal of generating billions of dollars in value for our shareholders. We invite you to benefit from our innovative and fast-growing business by earning 20% per year on your funds invested in our High-Yield Notes.

20% Interest Rate

Fast value multiplication of our Unicorns project enables us to pay the interest rate which is much higher than the 5.4% level of inflation. Our 20% interest rate far exceed the average paid on corporate bonds and the interest banks offer on savings accounts.

Backed by TransparentBusiness Group

Through our Unicorn Hunters show, we are developing a diversified portfolio of equity positions in numerous emerging growth companies, with the target asset multiplication of 80:1. Security of our High-Yield Notes is backed by all assets of TransparentBusiness Group, including our equity holdings.

Senior Unsecured

Notes offered to investors are not junior to any other obligation or security in our current capital structure.

Diversification Benefits

Our High-Yield Notes offer a unique risk/return profile and provide more predictable return than equity investments.

Extension Option

Investors have the option to extend the maturity date of the note by an additional year at the same interest rate.

1 Year Maturity Date

Structured to provide investors with short term and high-yield fixed income, our notes have a 1 year term to maturity.

Sources:

S&P Dow Jones Fixed Income Indicies;

U.S. Department of the Treasury

Meet the people who are passionate about improving the way people and companies work.

1. Personal data

2. Application form

3. Documents upload

4. Payment

POTENTIAL INVESTORS, PRIOR TO SUBSCRIBING TO THE SECURITIES DESCRIBED HEREIN, SHOULD READ THE OFFERING MEMORANDUM RELATED TO THESE SECURITIES, AND ALL RISK FACTORS AND EXHIBITS THEREIN IN THEIR ENTIRETY. THE SECURITIES DESCRIBED IN THE OFFERING MEMORANDUM INVOLVE A HIGH DEGREE OF RISK, AND RETURNS, INCLUDING RETURN OF CAPITAL, ARE NOT GUARANTEED. AN OFFER OF OUR SECURITIES IS MADE SOLELY BY THE OFFERING MEMORANDUM, WHICH DOES NOT CONSTITUTE AN OFFER TO ANYONE IN ANY COUNTRY OR STATE IN WHICH SUCH OFFER OR SOLICITATION IS NOT AUTHORIZED, OR TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE SUCH AN OFFER OR SOLICITATION.

Investors residing in the United States and Canada need to meet the accredited investor guidelines set forth in SEC Rule 501 and Rule 506(c) for US investors, or in section 1.1 of the National Instrument 45-106 for Canadian investors.

Non-US and non-Canada residents do not need to be accredited investors; this offer is open to non-US and non-Canada residents.

The minimum investment is $1,000. Any investments above the minimum must be made in increments of $1,000.

Interest accrues throughout the duration of the note and is paid at maturity.